Colruyt is a chain of supermarkets, started at Lembeek near Halle, Belgium. Colruyt carries the surname of the founder of the family business, the Colruyt family still owns the company. Colruyt is part of Colruyt Group, a Belgian multinational family business in wholesale distribution that evolved from the Colruyt supermarkets. It is competing with hard discounters such as Aldi and Lidl in Benelux countries where it is a well established market leader. The current manager is Jef Colruyt. The company’s retail trade division includes the direct supply of products to retail customers operating through brands Colruyt, OKay, Bio-Planet, DreamLand and ColliShop, among others. The company supplies to wholesalers and affiliated independent merchants in Belgium, France and Luxembourg. It also supplies fuels through DATS 24 filling stations in Belgium and France, provides printing and document management solutions (Druco/Mitto) and engineering activities (Intrion), and produces renewable energy (WE Power) (source: https://en.wikipedia.org/ )

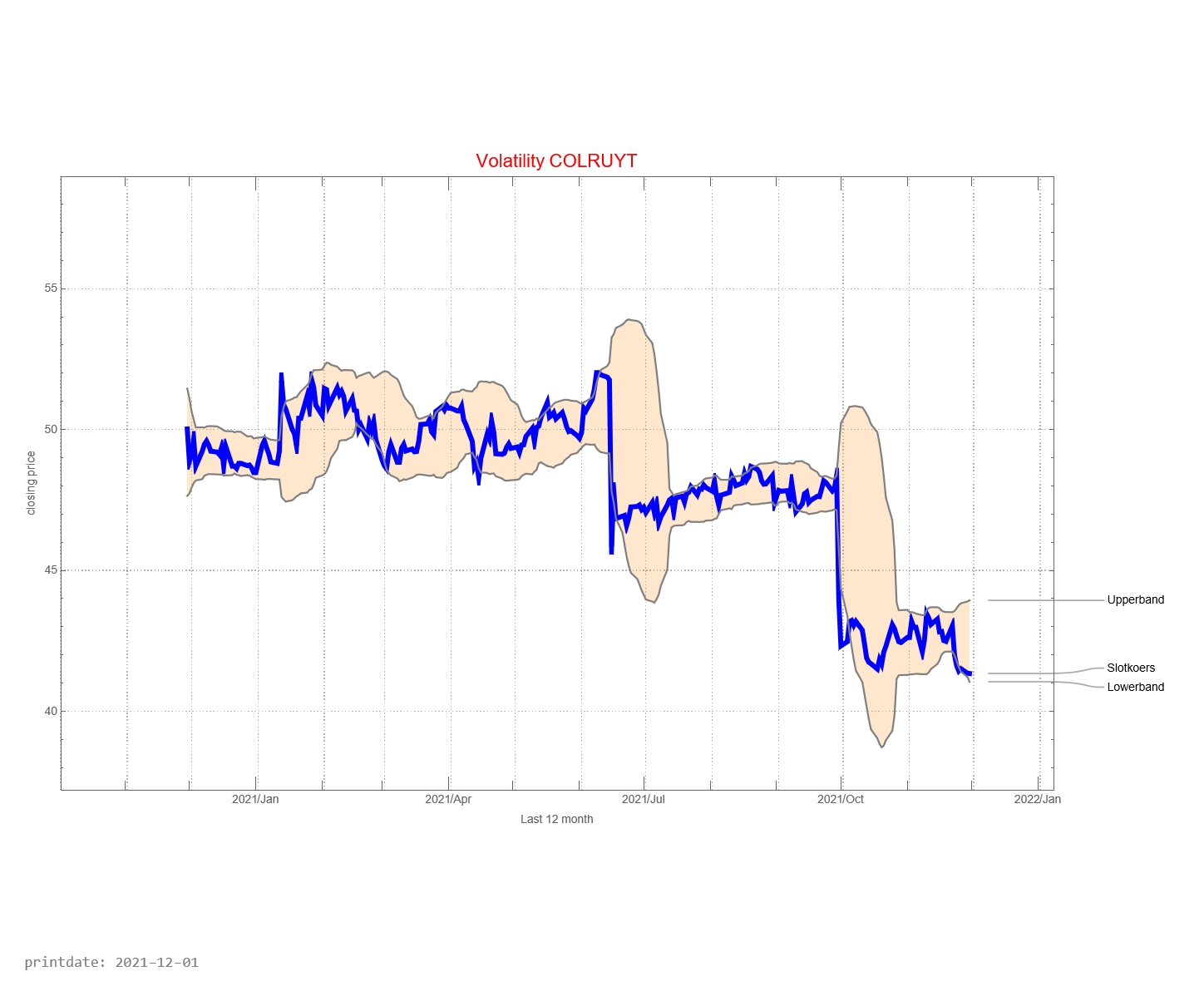

How does Colruyt develop in the past 12 months?

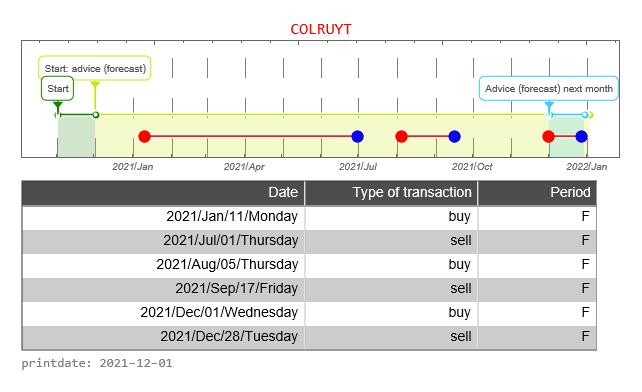

The graph below shows the history of issued buy and sell signals. The light blue part of the graph below shows the signals for the coming month. A red stop is “buy” and a blue dot is “sell”. The red line between buying and selling provides information about how long the Colruyt fund has been in the portfolio

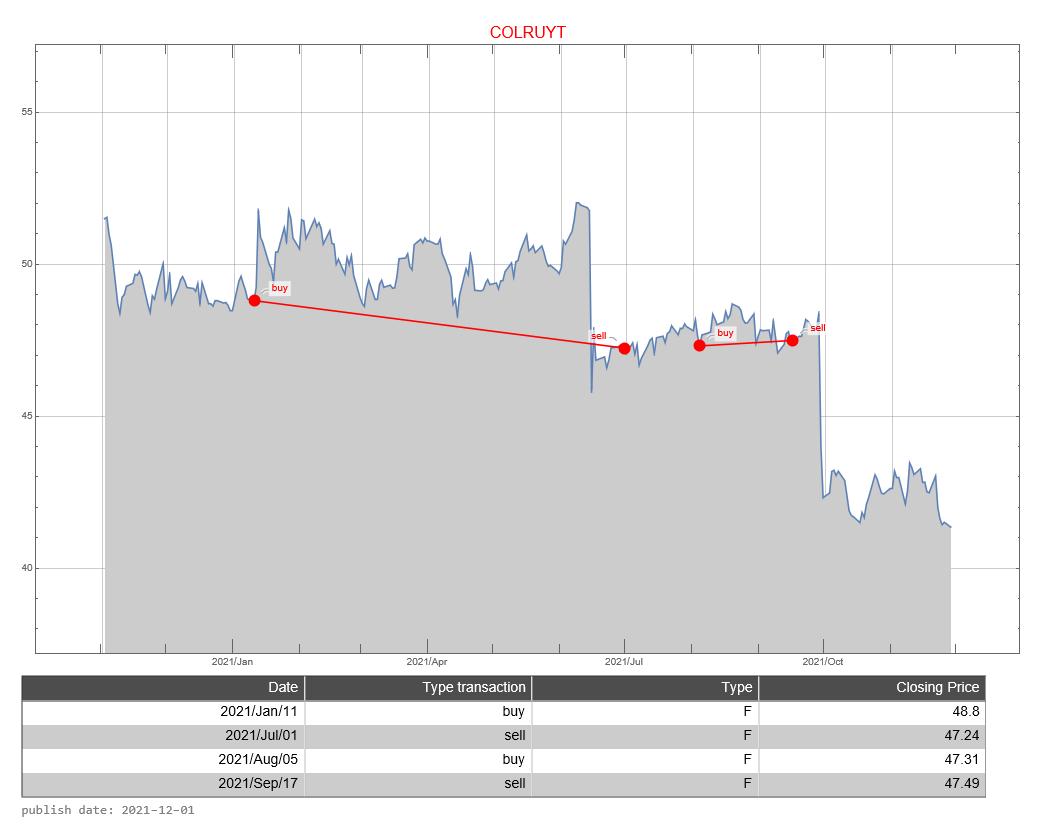

The graph below shows the buy and sell signals given in relation to the price development. In the table below you can see the date that a signal was issued, the type of signal (buy versus sell), whether the signal was issued in the forecast period, and the closing price of the stock on that day. The graph below, therefore, resembles the graph above to a certain extent, only without the forecast.

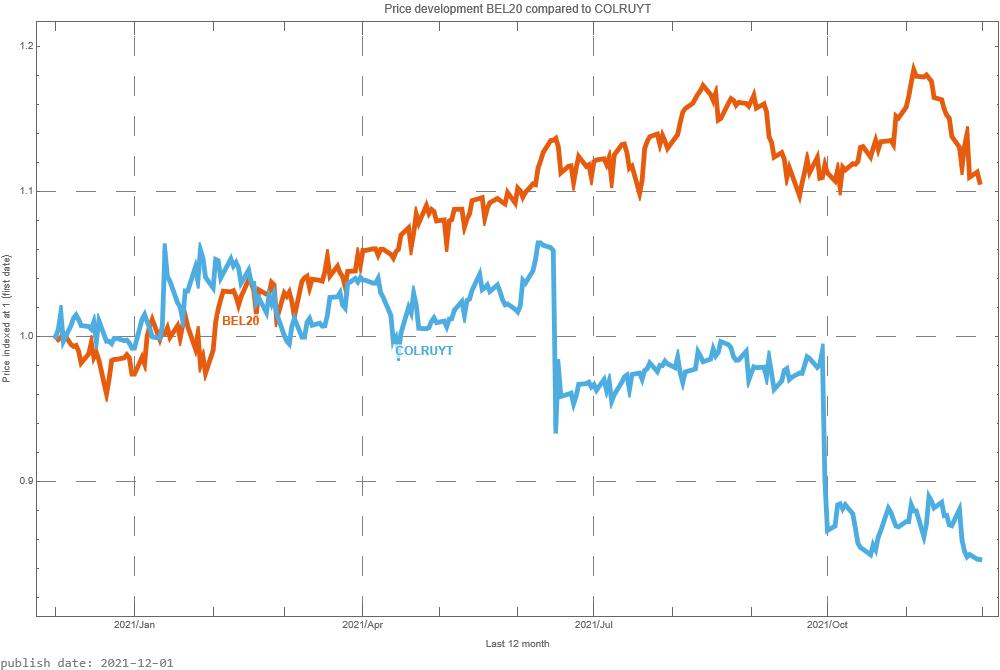

The BEL20 is a weighted average of the most important 20 companies whose shares can be traded on the Belgium Stock Exchange. It is now interesting to see how Colruyt share compares with the BEL20. In the graph above, we do this by starting both prices at the same level. That is, the price is indexed to “1”.

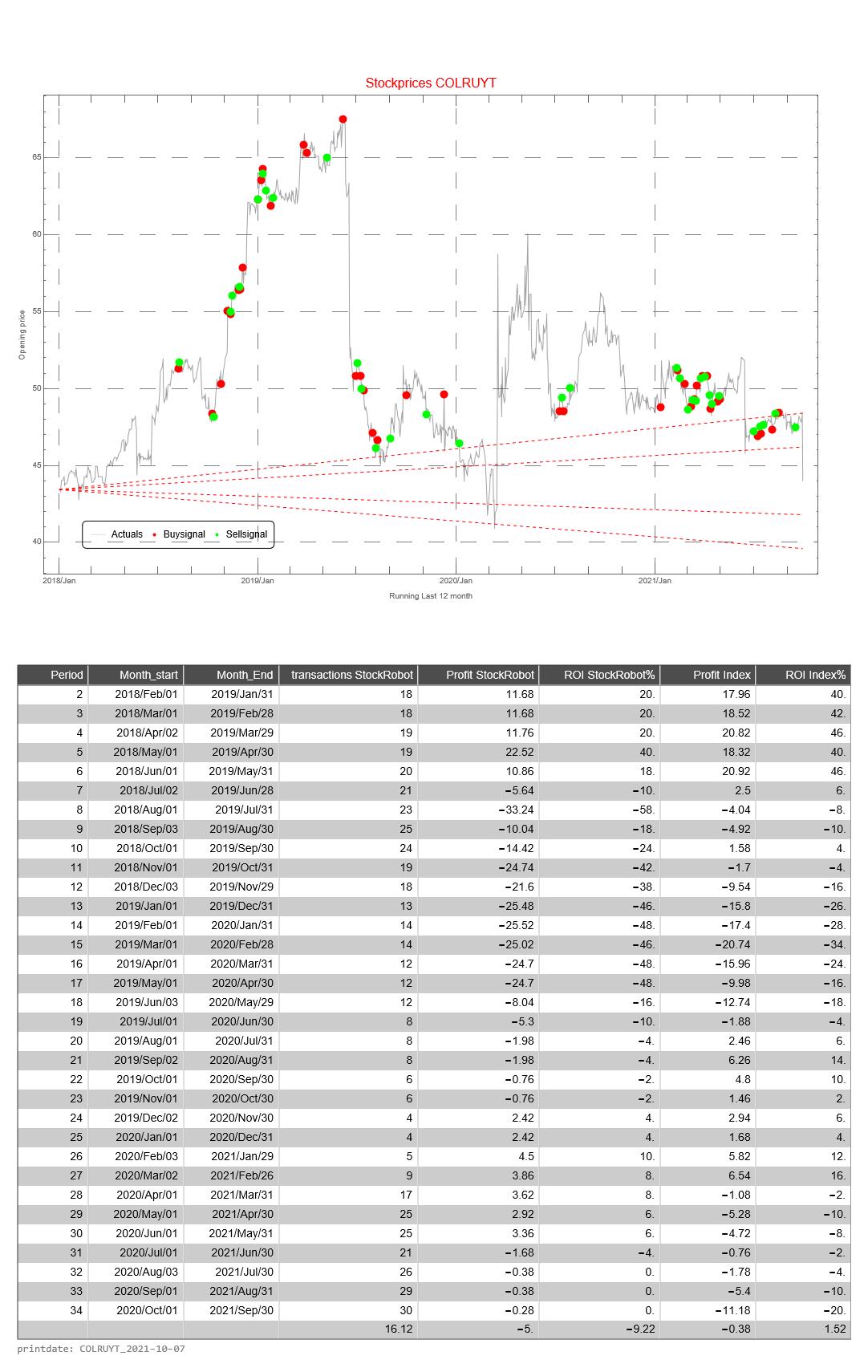

How well is the Trading Robot doing? For this, we make a simulation of 12 months each time. We calculate the return the trading robot would have made if you had followed signals for this fund. And we compare the result with if you would do nothing. That is, on day one you buy the fund and 365 days you sell the stock.

This simulation is repeated 31 times. The difference is that with each subsequent simulation the period shifts by one month. When shifting the 12 months, the simulation only looks at the buy and sell signals from that particular period.

The return of the Trading Robot is calculated as follows.

- the difference between the price of the fund between selling and buying (of 1 share of the relevant fund)

- we calculate the cumulative difference for multiple buy and sell signals

- if there has been no sell signal at the end of the 12-month period, we use the price on the last day of the 12-month period

- we calculate the average price value of a buy signal

- the cumulative difference divided by the average price is the return over the 12 months

The Profit HR (Trading Robot Profit) is the cumulative difference between buy and sell signals of 1 share of the relevant fund

The return of the Trading Robot is the Profit over the last 12 month divided by the price value of the first day of a 12-month period of the relevant fund