TKH Group (TKH) is an internationally operating group of companies specializing in the development and delivery of innovative systems and networks for information provision, telecommunication, electrical engineering and industrial production.

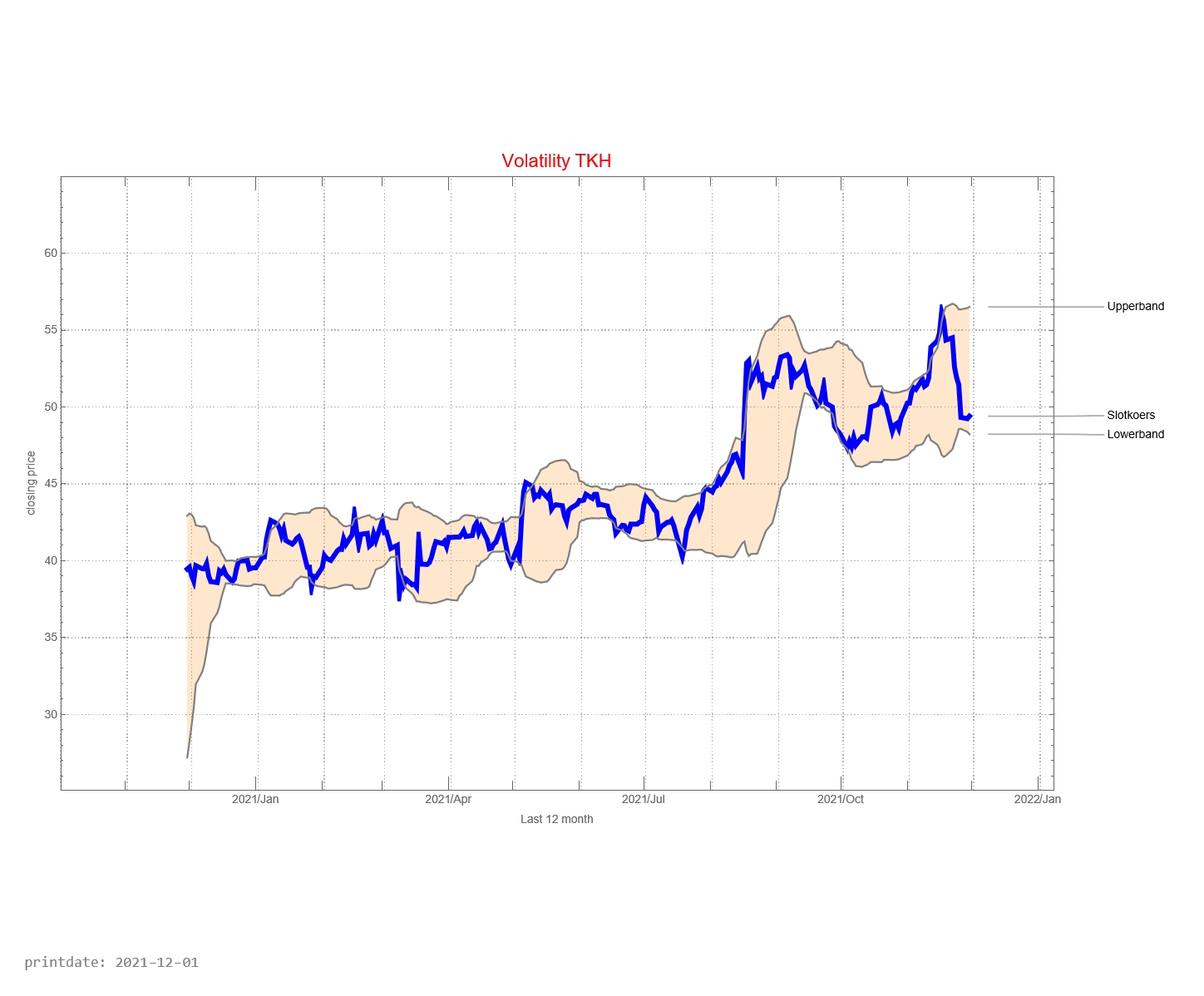

How does TKH Group develop in the past 12 months? In this chart, you see the price development in relation to the ‘degree of price movement’ in the previous 20 days. Technical analysts also refer to the Bollinger Bands (named after John Bollinger). The idea is that when the price approaches the upper limit, there is an overbought market. In other words: the share is popular. If the real price approaches the lower bound, then there would be an ‘underbought market’. In other words: the share has been sold too often. A broad bandwidth is an indication of high volatility and therefore an increased risk. A narrow bandwidth (analysts then refer to it as a ‘squeese’) is an indication of low volatility and therefore less risk.

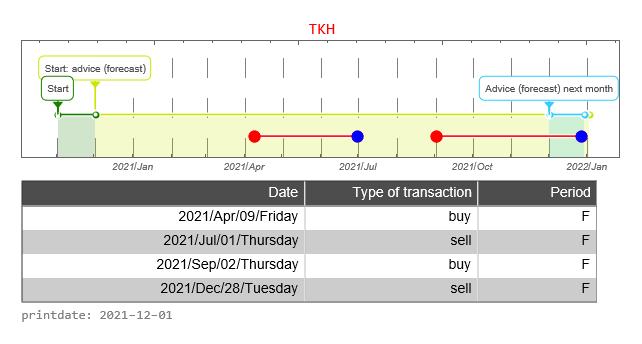

The graph below shows the history of issued buy and sell signals. The light blue part of the graph below shows the signals for the coming month. A red stop is “buy” and a blue dot is “sell”. The red line between buying and selling provides information about how long the TKH Group fund has been in the portfolio

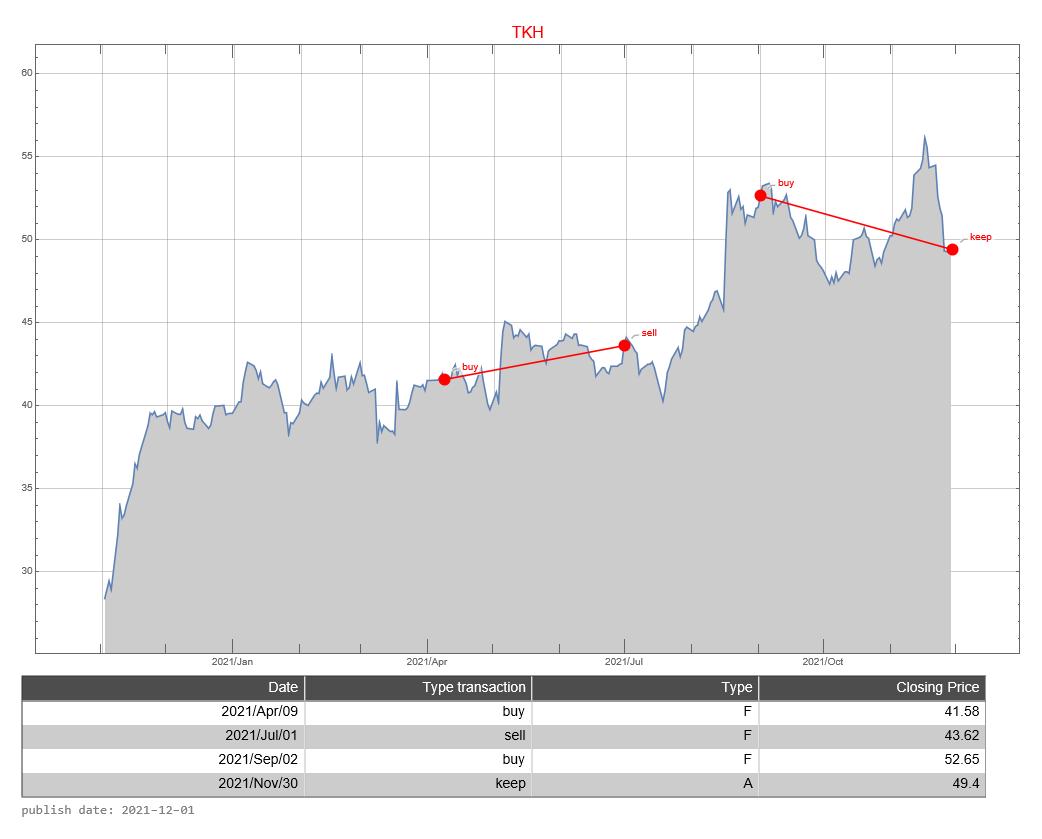

The graph below shows the buy and sell signals given in relation to the price development. In the table below you can see the date that a signal was issued, the type of signal (buy versus sell), whether the signal was issued in the forecast period, and the closing price of the stock on that day. The graph below, therefore, resembles the graph above to a certain extent, only without the forecast.

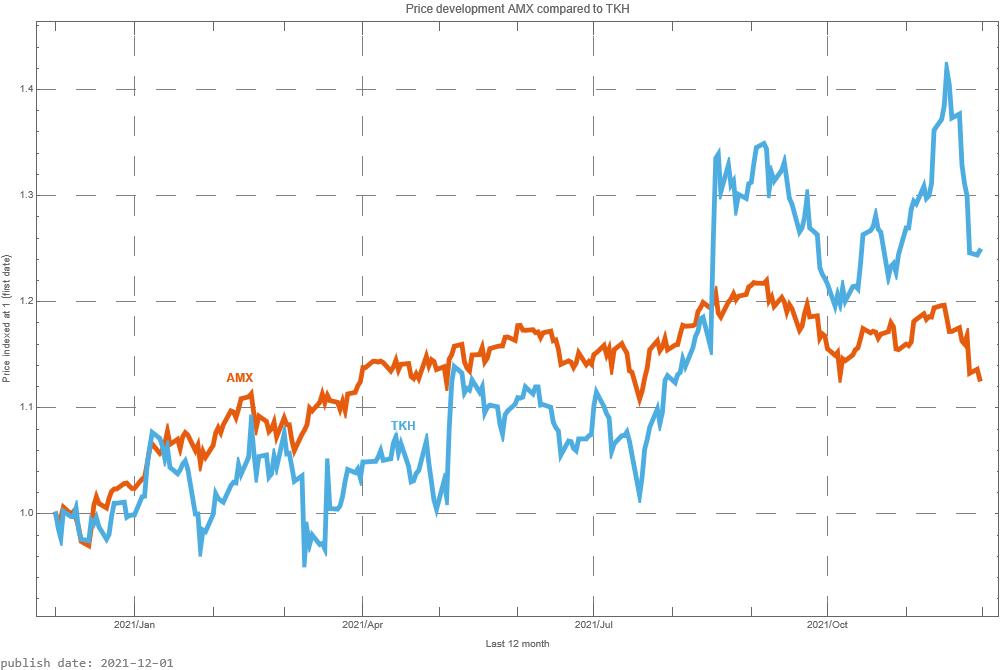

The AMX-index is a weighted average of the most important 23 companies whose shares can be traded on the Amsterdam Stock Exchange. It is now interesting to see how TKH Group share compares with the AMX-index. In the graph above, we do this by starting both prices at the same level. That is, the price is indexed to “1”.

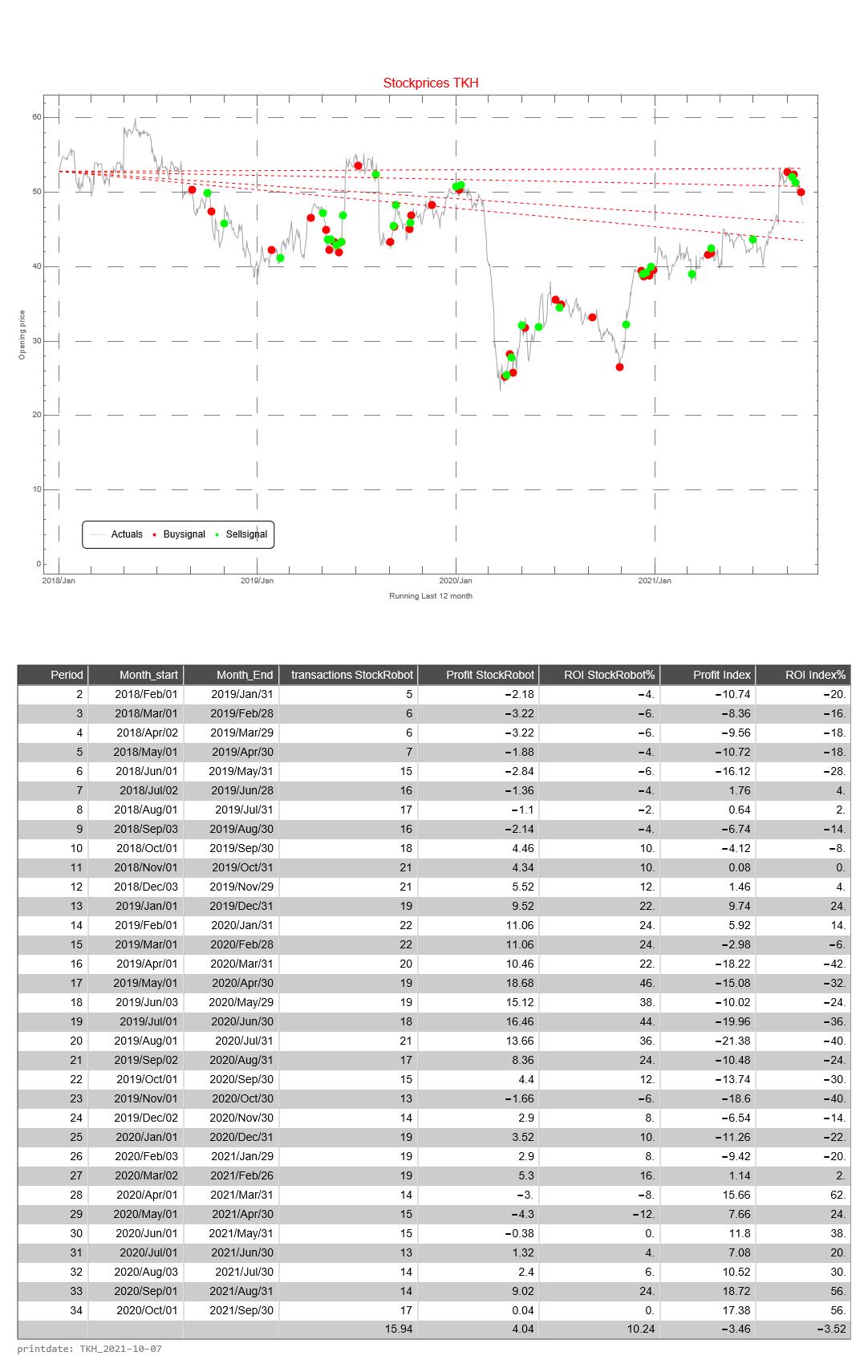

How well is the Trading Robot doing? For this, we make a simulation of 12 months each time. We calculate the return the trading robot would have made if you had followed signals for this fund. And we compare the result with if you would do nothing. That is, on day one you buy the fund and 365 days you sell the stock.

This simulation is repeated 31 times. The difference is that with each subsequent simulation the period shifts by one month. When shifting the 12 months, the simulation only looks at the buy and sell signals from that particular period.

The return of the Trading Robot is calculated as follows.

- the difference between the price of the fund between selling and buying (of 1 share of the relevant fund)

- we calculate the cumulative difference for multiple buy and sell signals

- if there has been no sell signal at the end of the 12-month period, we use the price on the last day of the 12-month period

- we calculate the average price value of a buy signal

- the cumulative difference divided by the average price is the return over the 12 months

The Profit HR (Trading Robot Profit) is the cumulative difference between buy and sell signals of 1 share of the relevant fund

The return of the Trading Robot is the Profit over the last 12 months divided by the price value of the first day of a 12-month period of the relevant fund

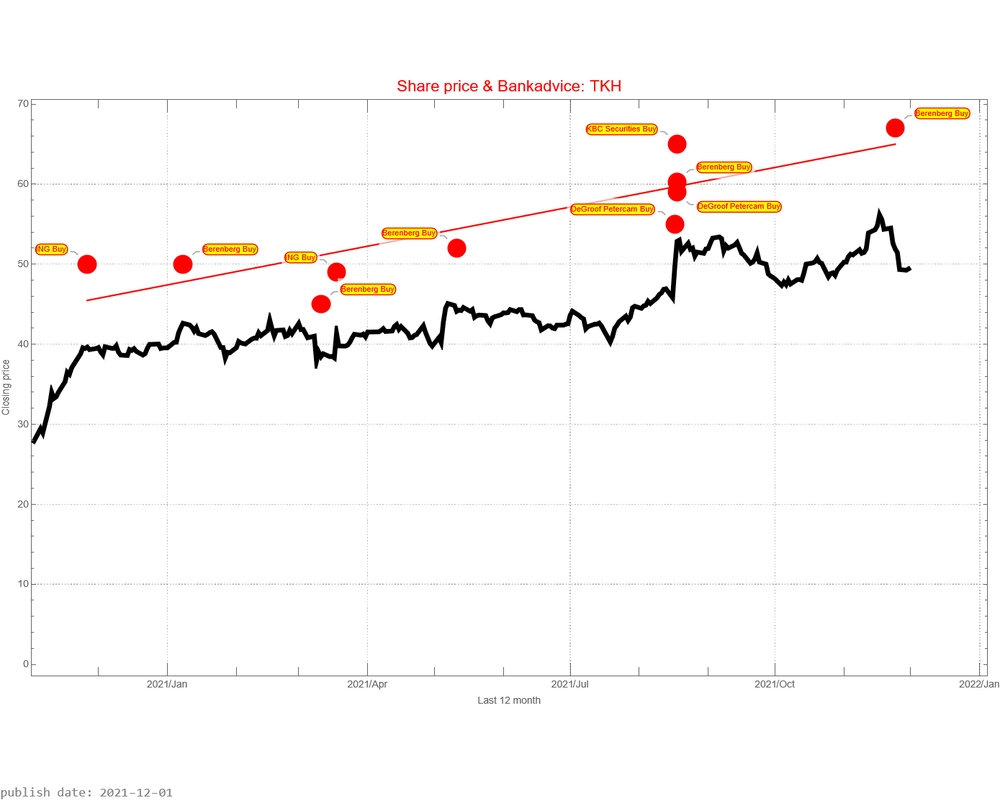

This graph not only shows the price development but also the various bank advice (buy or sell) and the moment that this advice was issued. The “Red Bullets” are the issued price targets of the issued advice. It is never stated when the intended price targets must be achieved.