Mota-Engil is a Portuguese group in the sectors of civil construction, public works, port operations, waste, water, and logistics. The chairman of the board of directors is António Mota and Gonçalo Moura Martins is the company’s CEO. Jorge Coelho has led the group’s Executive Committee from 2008 to 2013 and currently is a consultant in Mota-Engil’s Strategic Advisory Council. The registered office of this business group is in Amarante, the municipality where it was founded. Its head offices are located in Porto and Lisbon. The Mota-Engil Group comprises 228 companies within three major business areas – Engineering and construction, Environment and Services and Transport concessions – operating in 21 countries through its branches and subsidiaries, including Mota-Engil Engenharia e Construção, S.A., Tertir, SUMA, INDAQUA, Manvia, Vibeiras, Ascendiand Martifer. Mota-Engil has comprised the ranking of the 100 biggest European construction companies in 2008,[10] but currently[when?] comprises the ranking of the sector’s 30 biggest European companies and it is the only Portuguese company in the World Top 100. Mota-Engil SGPS, the group’s holding, is listed in the PSI-20, the main stock market index of Euronext Lisbon. (https://en.wikipedia.org/wiki/Mota-Engil)

How does Mota-Engil develop in the past 12 months?

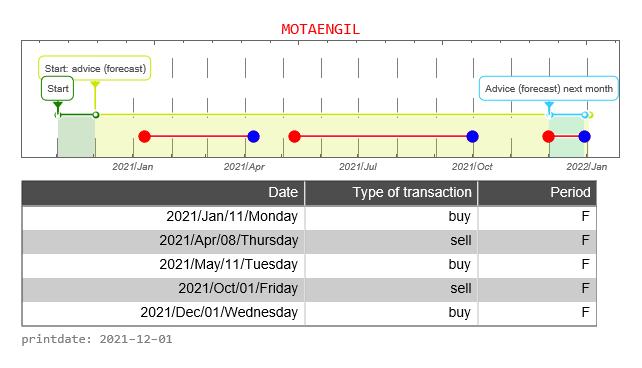

The graph below shows the history of issued buy and sell signals. The light blue part of the graph below shows the signals for the coming month. A red stop is “buy” and a blue dot is “sell”. The red line between buying and selling provides information about how long the Mota-Engil fund has been in the portfolio

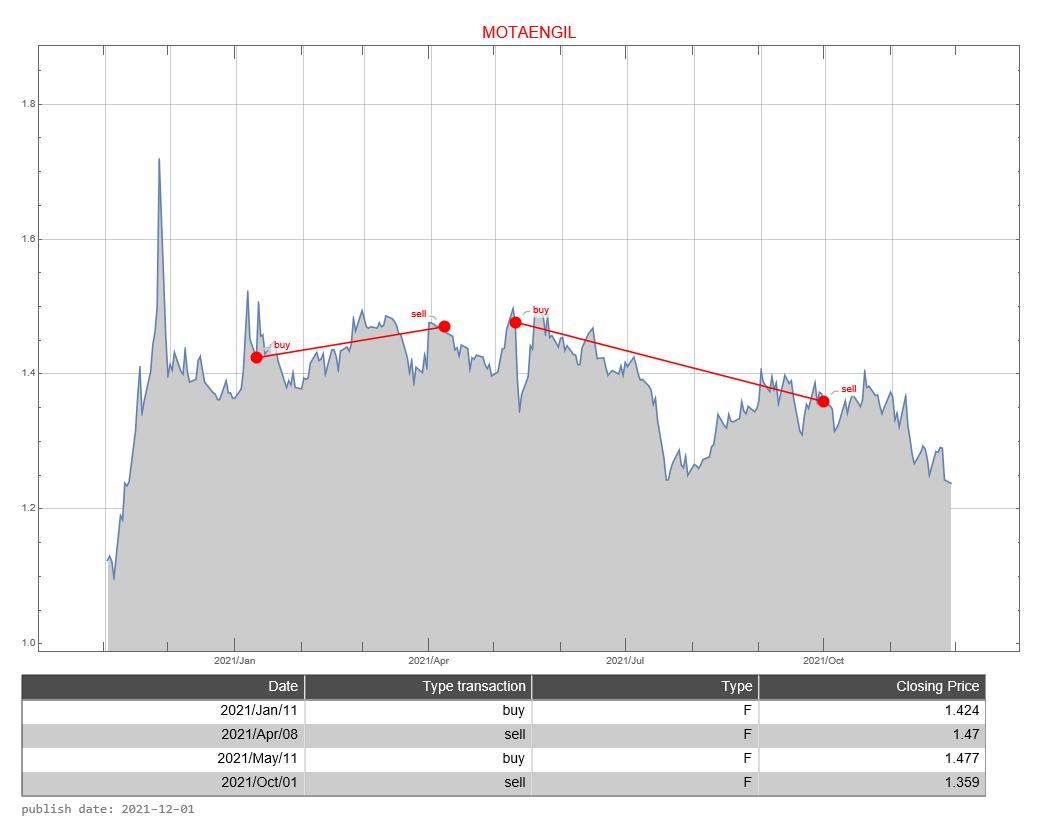

The graph below shows the buy and sell signals given in relation to the price development. In the table below you can see the date that a signal was issued, the type of signal (buy versus sell), whether the signal was issued in the forecast period, and the closing price of the stock on that day. The graph below, therefore, resembles the graph above to a certain extent, only without the forecast.

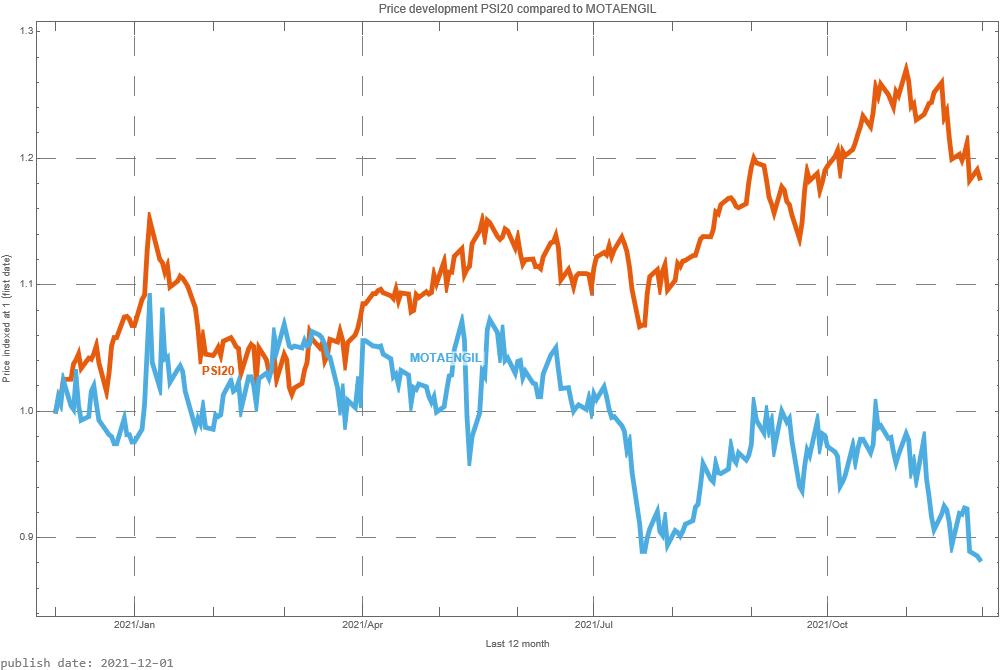

The PSI20 is a weighted average of the most important 18 companies whose shares can be traded on the Lisbon Stock Exchange. It is now interesting to see how Mota-Engil share compares with the PSI20. In the graph above, we do this by starting both prices at the same level. That is, the price is indexed to “1”.

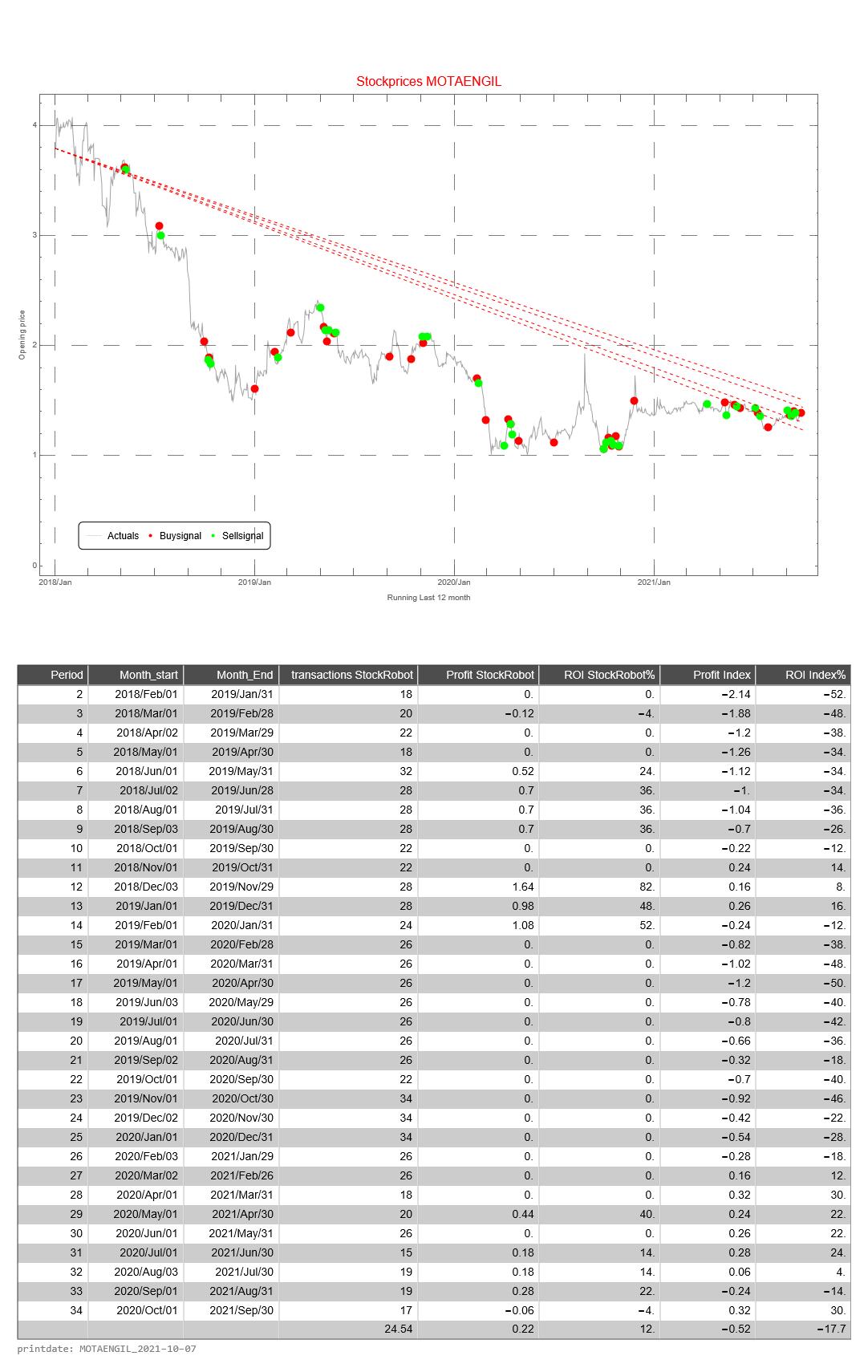

How well is the Trading Robot doing? For this, we make a simulation of 12 months each time. We calculate the return the trading robot would have made if you had followed signals for this fund. And we compare the result with if you would do nothing. That is, on day one you buy the fund and 365 days you sell the stock.

This simulation is repeated 31 times. The difference is that with each subsequent simulation the period shifts by one month. When shifting the 12 months, the simulation only looks at the buy and sell signals from that particular period.

The return of the Trading Robot is calculated as follows.

- the difference between the price of the fund between selling and buying (of 1 share of the relevant fund)

- we calculate the cumulative difference for multiple buy and sell signals

- if there has been no sell signal at the end of the 12-month period, we use the price on the last day of the 12-month period

- we calculate the average price value of a buy signal

- the cumulative difference divided by the average price is the return over the 12 months

The Profit HR (Trading Robot Profit) is the cumulative difference between buy and sell signals of 1 share of the relevant fund

The return of the Trading Robot is the Profit over the last 12 month divided by the price value of the first day of a 12-month period of the relevant fund