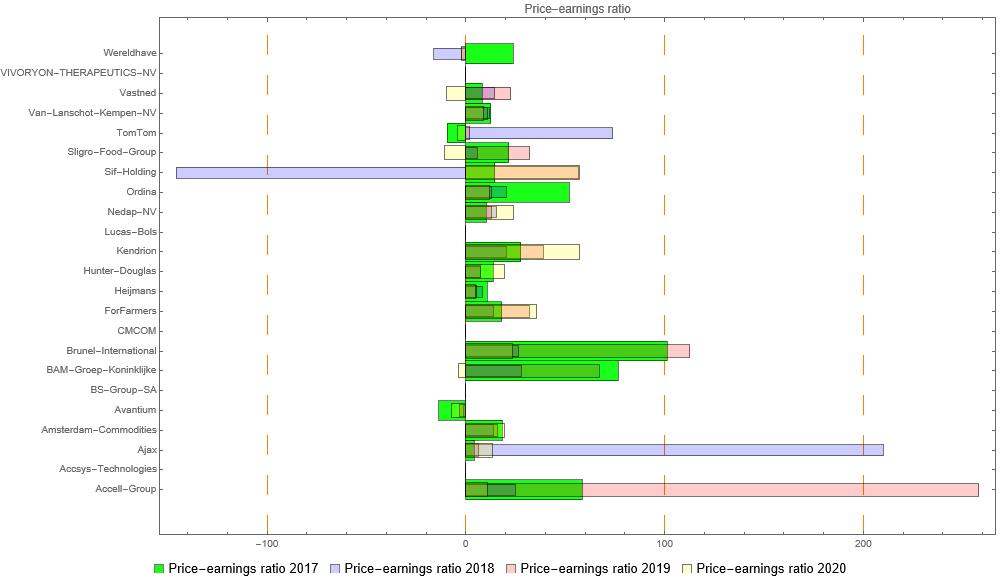

The price-earnings ratio is calculated by dividing the price of a share by the earnings per share. The higher the P / E ratio, the more expensive the share. This ratio says something about the valuation of the stock and the profit expectations of the company. If a company is not making a profit, the price-earnings ratio cannot be calculated. The higher this ratio, the more expensive the share. Still, a high price-earnings ratio can indicate that a stock is attractive. The ratio can say something about the share in two ways. First of all, the price-earnings ratio can say something about the valuation of a stock. A low ratio may indicate that the price is undervalued. If the ratio is high, this may indicate overvaluation. However, the ratio may also say something about the company’s earnings expectations for the coming years. At a low ratio, the profit of a company is expected to decrease. A high ratio may indicate that a large profit increase is expected.

You can therefore easily and quickly calculate with the ratio whether you pay relatively much or relatively little for a share. In a company without profit, no P / E ratio can be calculated.

- 0 to 10 The price is undervalued or the profit from the company is (expected) to decrease.

- 10 to 17 For many companies this P / E ratio is seen as reasonable.

- 17 to 25 The price is overvalued or the profit expectations for the share are extremely high.

- 25+ The company has a bright future or there is a bubble effect. In addition, such a p / w ratio can indicate a growth share.